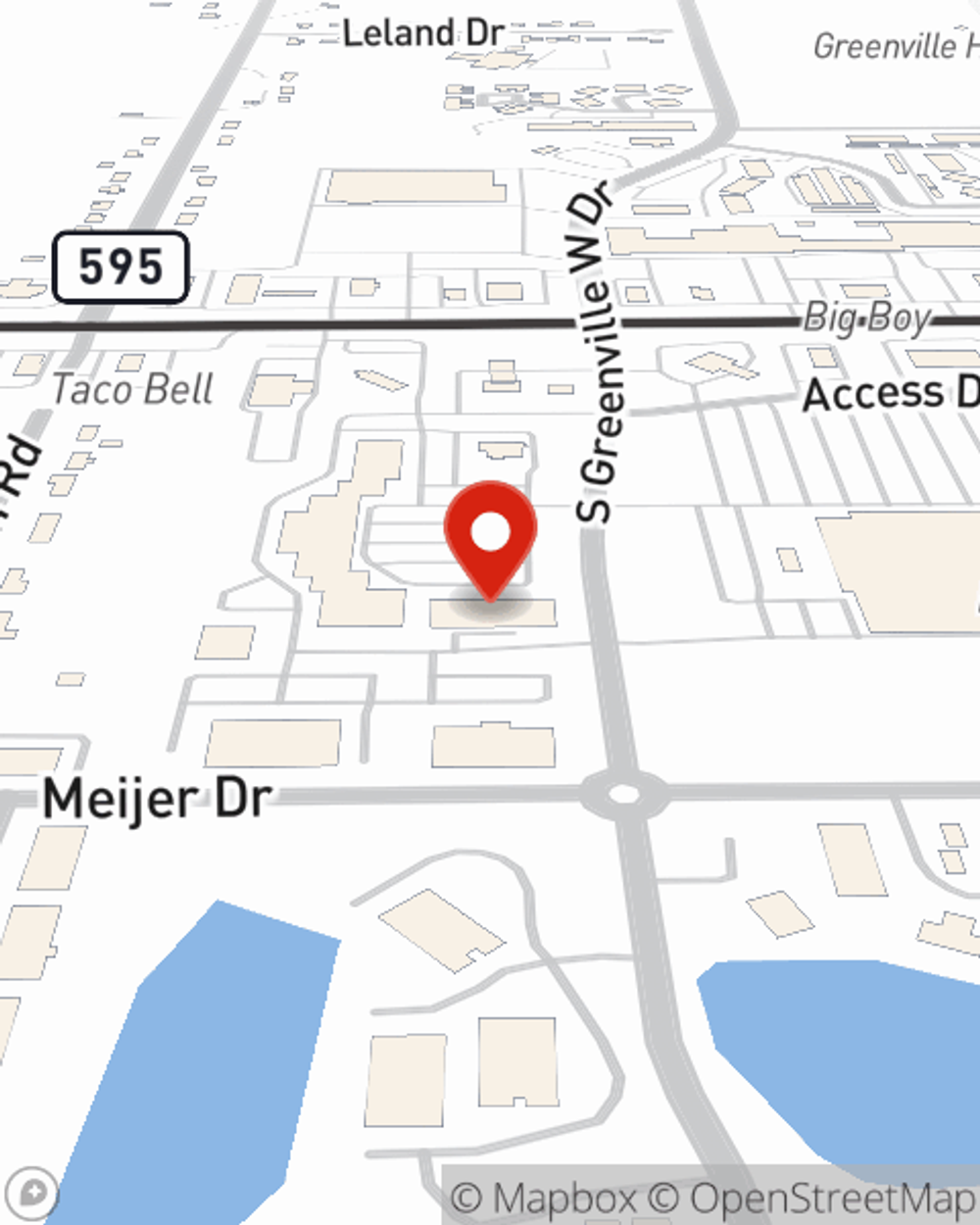

Life Insurance in and around Greenville

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Greenville, MI

- Sheridan, MI

- Gowen, MI

- Belding, MI

- Sidney, MI

- Fenwick, MI

- Rockford, MI

- Stanton, MI

- Cedar Springs, MI

- Edmore, MI

- Ionia, MI

- Orlean, MI

- Trufant, MI

- Langston, MI

- Crystal, MI

- Carson City, MI

- Six Lakes, MI

- Howard City, MI

- Sand Lake, MI

It's Time To Think Life Insurance

It may make you pained to focus on when you pass away, but preparing for that day with life insurance is one of the most significant ways you can show care to the people you're closest to.

Coverage for your loved ones' sake

Life happens. Don't wait.

Why Greenville Chooses State Farm

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Jenni Pattillo. Jenni Pattillo is the understanding representative you need to consider all your life insurance needs. So if you're gone, the beneficiary you designate in your policy will help your family or the ones you hold dear with important living expenses such as your funeral costs, rent payments and retirement contributions. And you can rest easy knowing that Jenni Pattillo can help you submit your claim so the death benefit is presented quickly and properly.

Don’t let worries about your future stress you out. Visit State Farm Agent Jenni Pattillo today and discover how you can benefit from State Farm life insurance.

Have More Questions About Life Insurance?

Call Jenni at (616) 754-7809 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Jenni Pattillo

State Farm® Insurance AgentSimple Insights®

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.